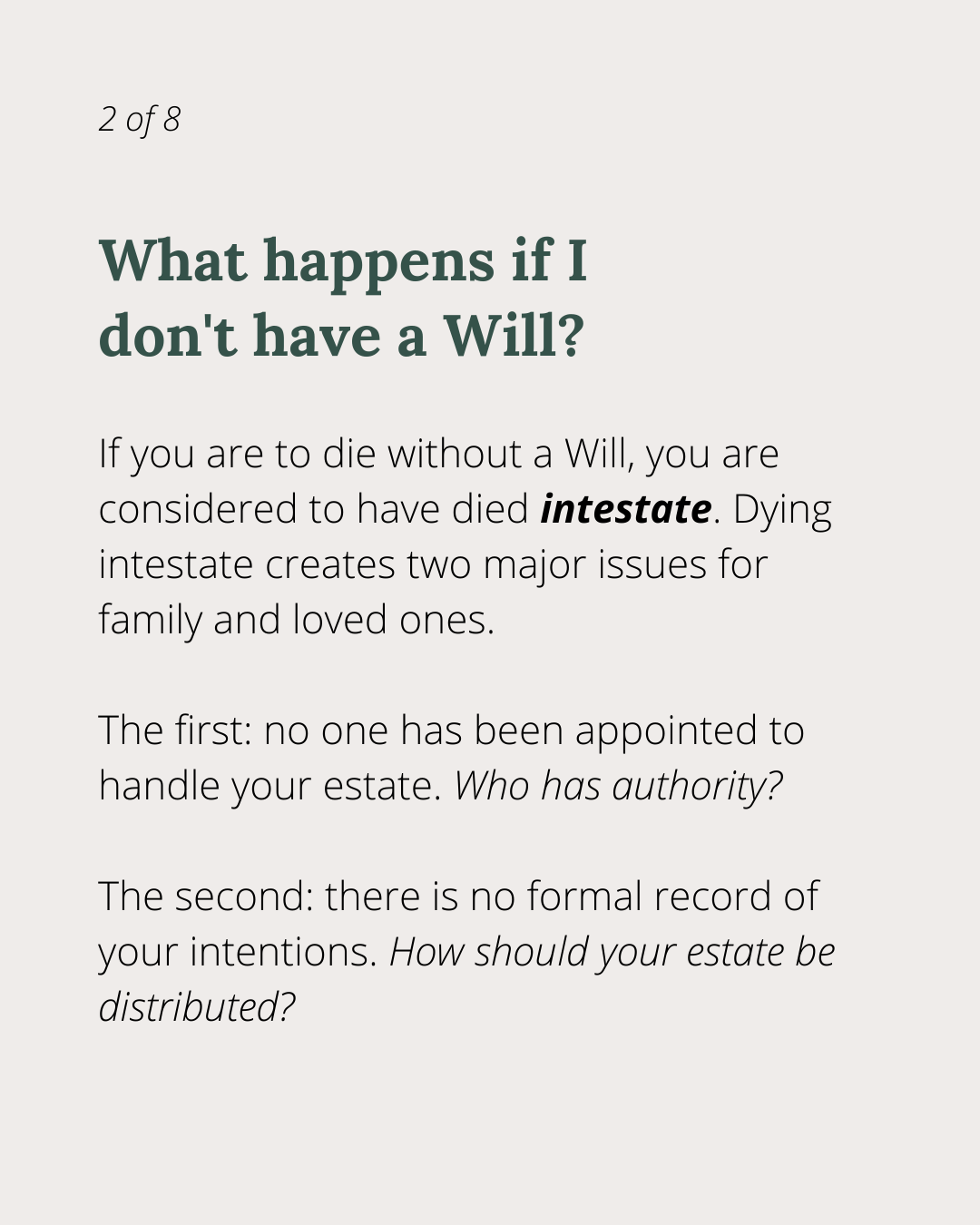

What happens if I don’t have a Will?

If you are to die without a Will, you are considered to have died “intestate”. Dying intestate creates two major issues for family and loved ones. The first being: no one has been appointed to handle your estate. Who will manage things? The second issue being: no record of your personal wishes exists. How is your estate to be distributed? To whom?

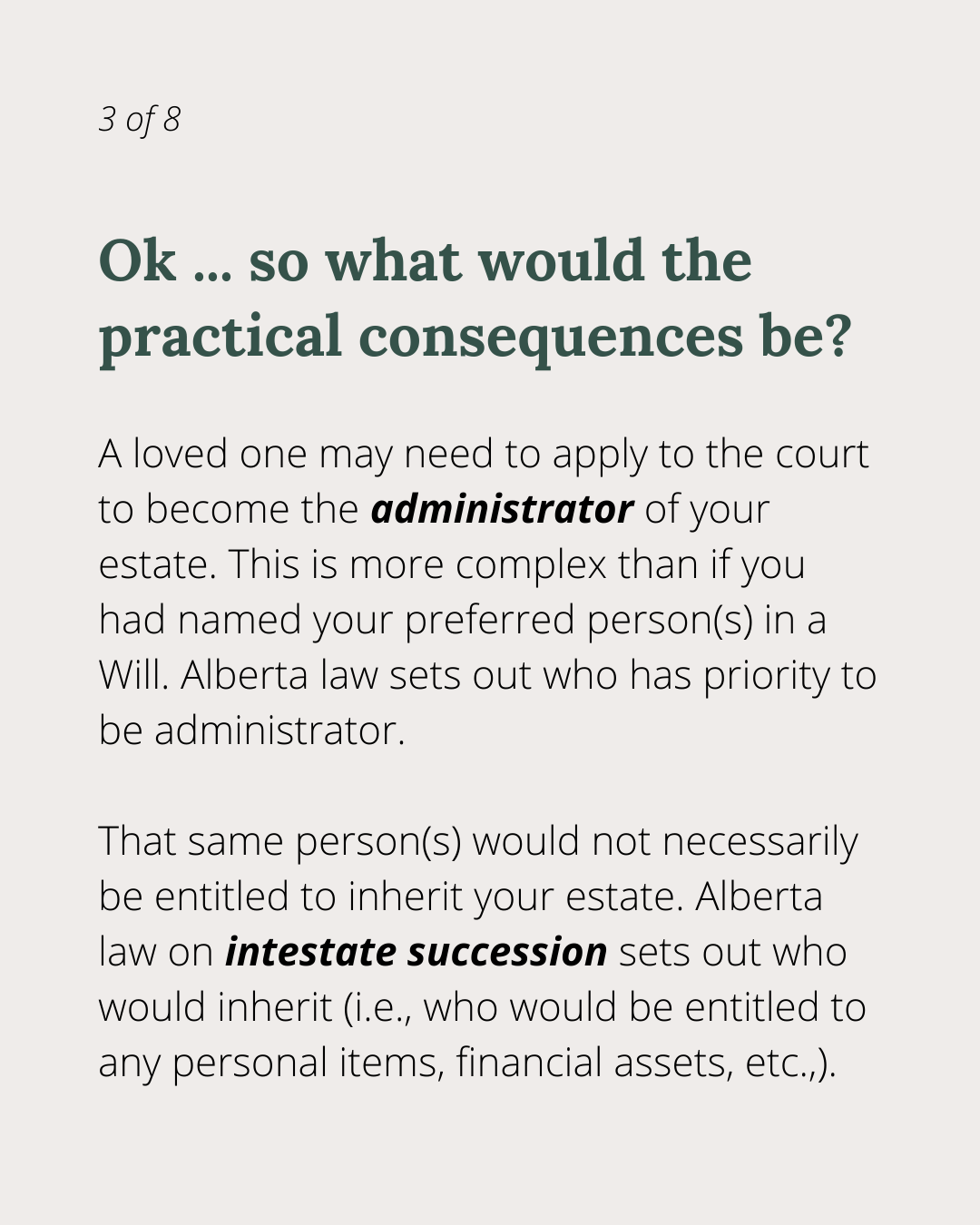

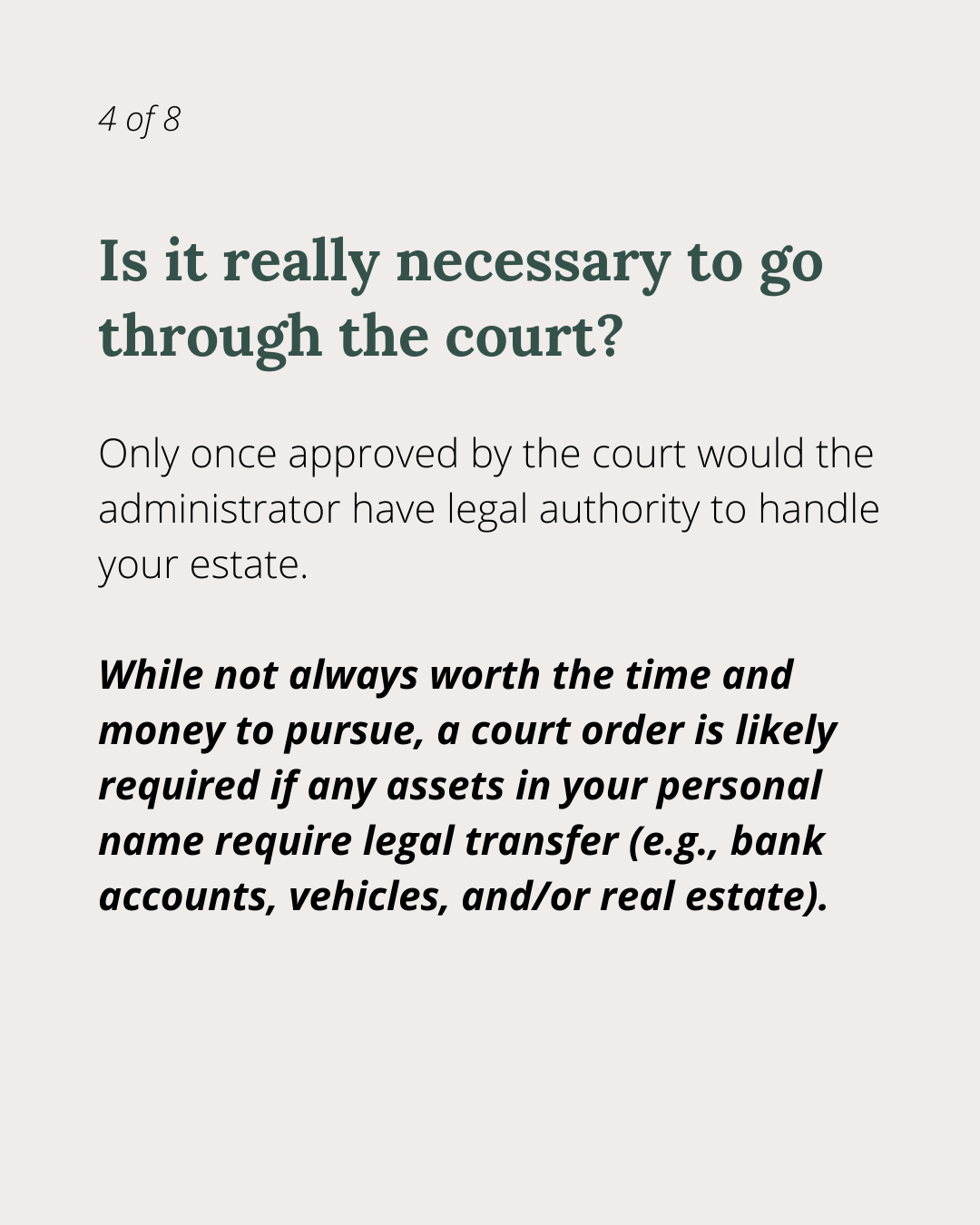

Often a Grant of Administration is required from the court. This is formal approval from the court of who is handling the estate and who they are distributing assets to. Any assets registered in a person’s name likely require a Grant from the court in order to be transferred/sold.

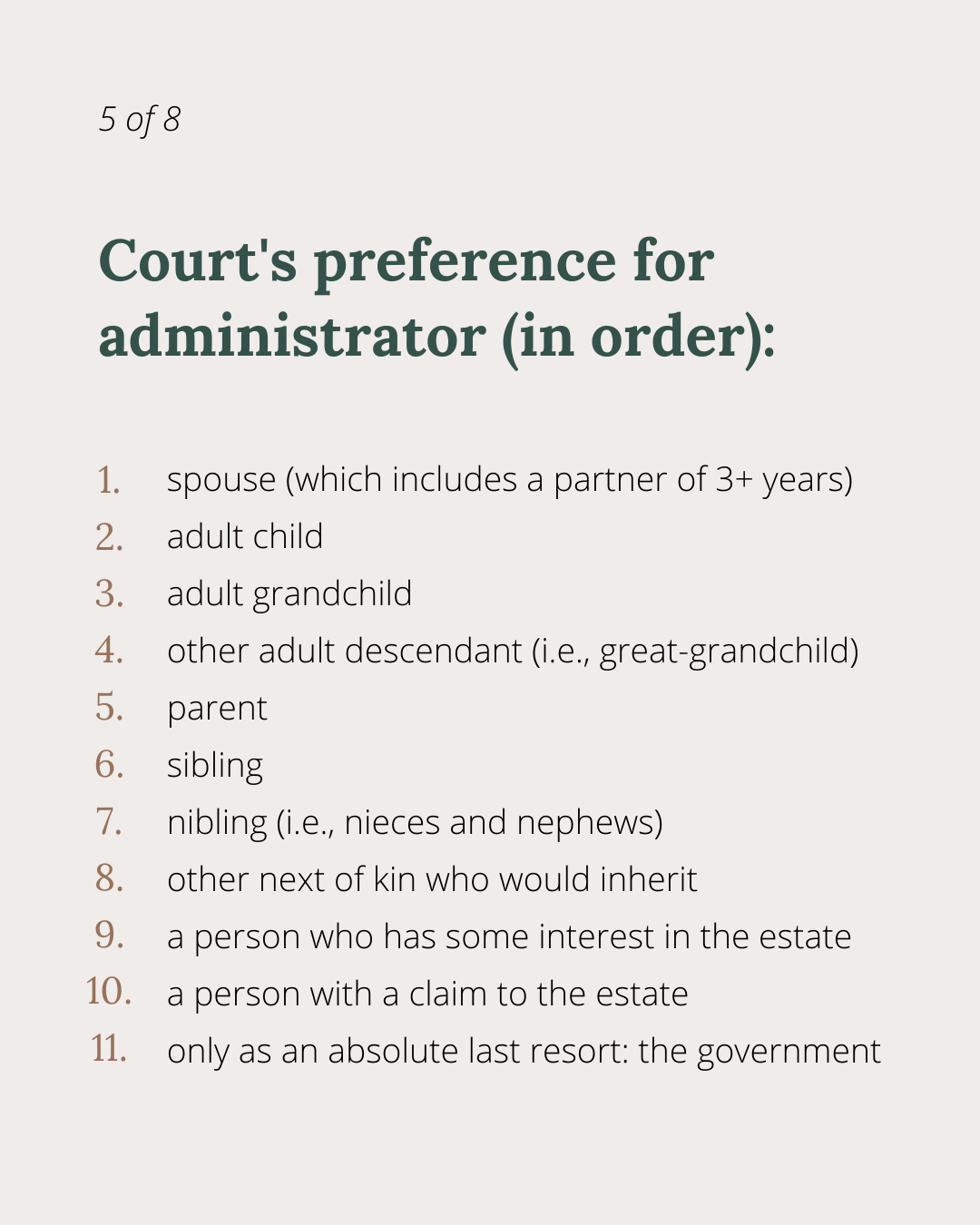

In Alberta, order of priority to apply for a Grant is as follows:

the surviving spouse or surviving adult interdependent partner;

a child of the deceased;

a grandchild of the deceased;

issue of the deceased other than a child or grandchild;

a parent of the deceased;

a brother or sister of the deceased;

a child of the brother or sister of the deceased;

next of kin who are heirs on intestacy and who are not otherwise referred to in the legislation;

a person who has an interest in the estate;

a claimant; and

the crown (i.e., the government).

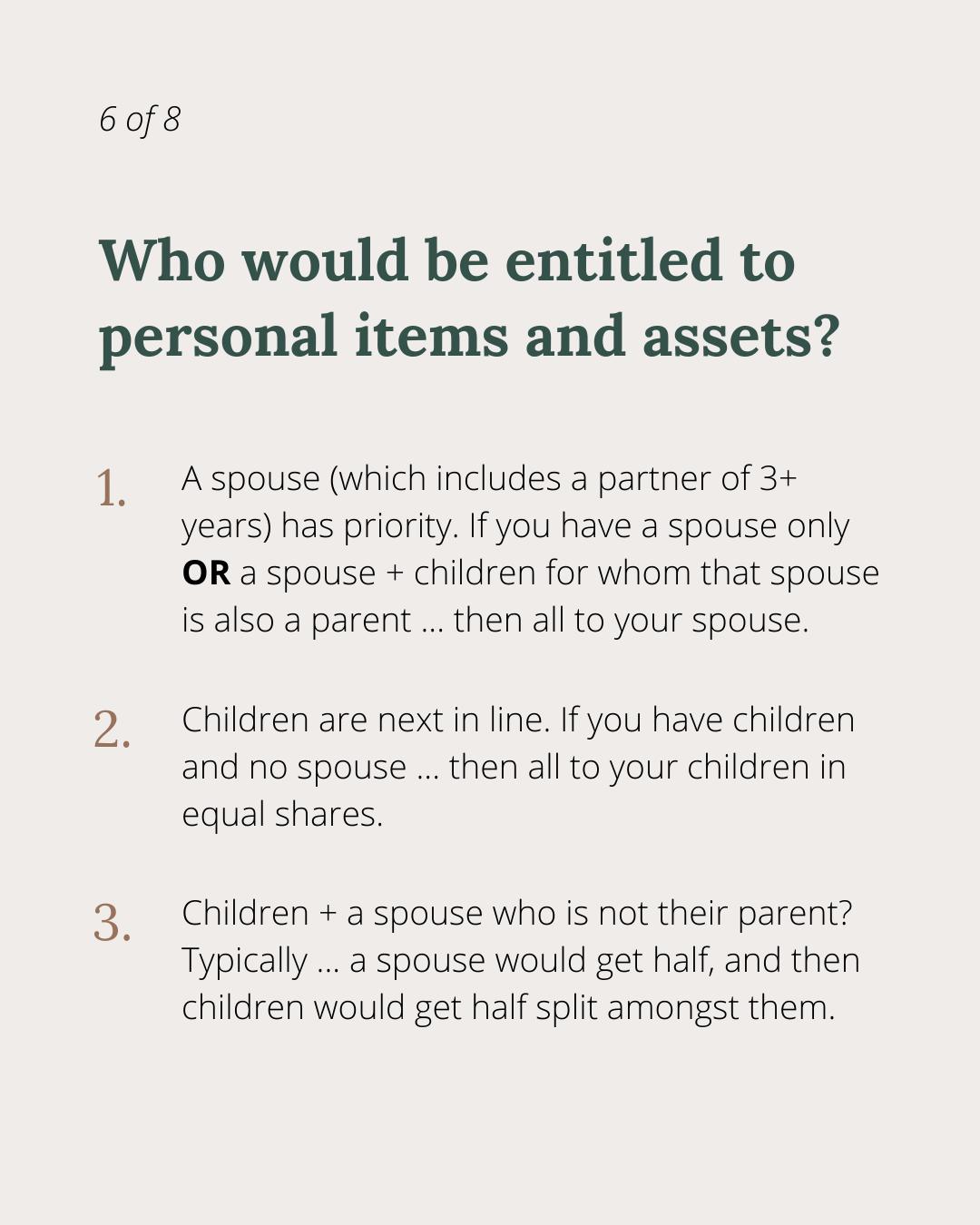

But who would be entitled to the assets?

Spouse only … all to spouse.

Children only … all to children in equal shares.

Spouse and children …

If spouse is also the parent of all children, then all to the spouse.

If the children are not the spouse’s children, then the spouse is entitled to the greater of 50% of the estate or $150,000 CAD. The remainder would be split amongst the children in equal shares.

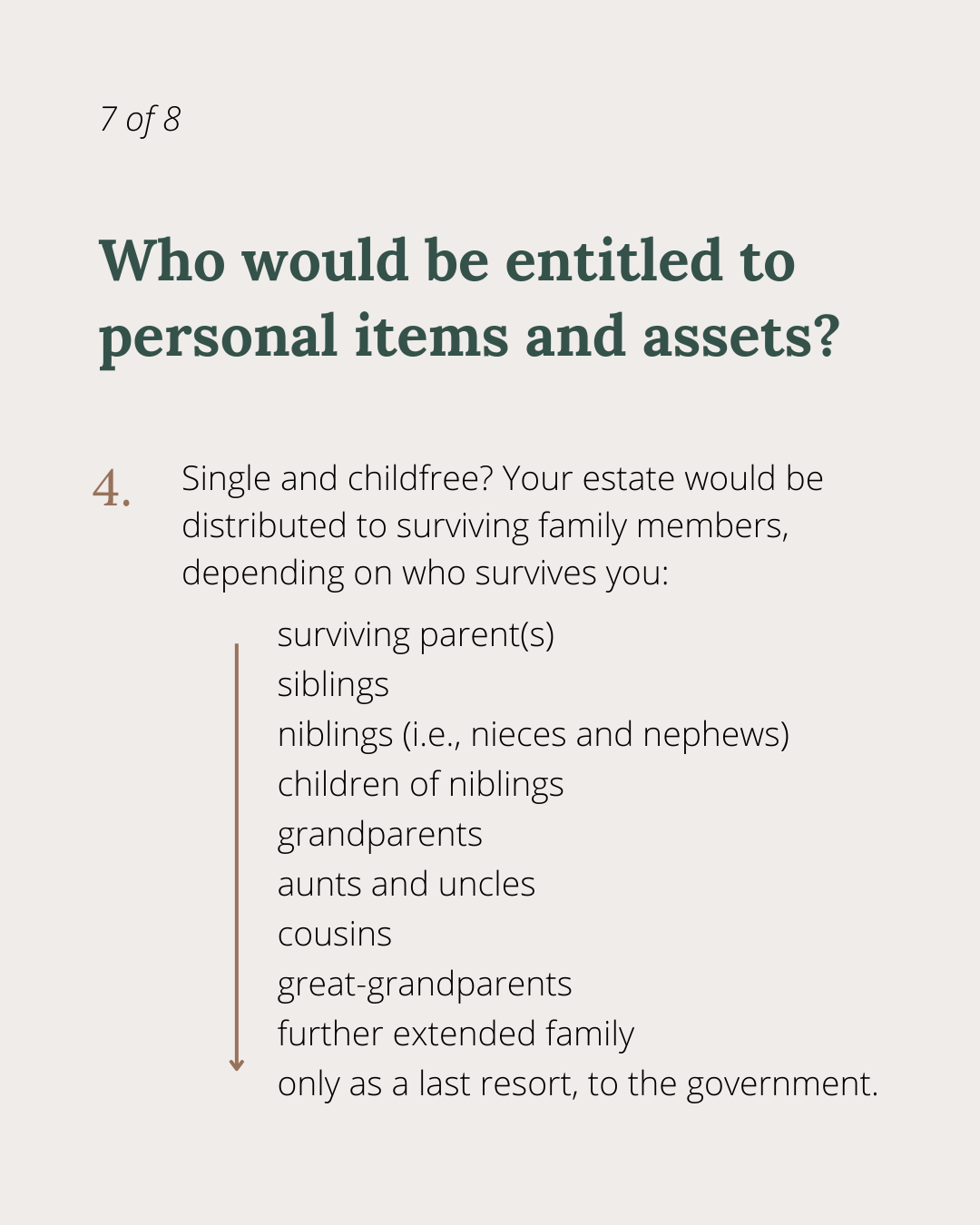

Childfree and single … all to family members, depending on who survives you.

The usual order of distribution is parents; then descendants of the parents (stopping at grandnieces/nephews); then half to maternal grandparents or their descendants (stopping at cousins) + half to paternal grandparents or their descendants (stopping at cousins). If none of the above-mentioned people are then living, this process is repeated with great-grandparents. Only as an absolute last resort … to the government.

Estate administration is certainly manageable … but it can be a tedious process. Selecting an appropriate person to manage your estate is one of the biggest decisions to be made in the estate planning context. We prefer to use the term “loved ones” as “family” is not exclusively made up of legal family members … but the legislation is not capable of making this distinction.

Therefore, having a valid, up-to-date Will is essential to ensure your personal and financial wishes are met. Wills reducing the amount of stress on loved ones during an extremely difficult time.

The post contains legal information of general applicability. It is not legal advice to any one person. It does not account for your personal circumstances. Do not rely on the information above; seek personalized legal advice. We do out best to ensure this information is accurate as of the date of publishing however, we will not update this information going forward.

Thanks very much to Katelyne Steele for her assistance in preparing this post! We are so grateful to have her. Here is some more info about Katelyne:

Hi, my name is Katelyne, and I am a policy studies intern at Modern Wills for the 2023 summer! I enjoy the opportunity to research and inform on estate legislation, rules, guidelines, etc., for our clients to read and better understand estate planning.